Upon reaching age 65, Medicare beneficiaries have two health insurance options. Eligible adults can enroll in traditional fee-for-service (FFS) Medicare or join Medicare Advantage (MA), which provides private plan alternatives. Since its inception, the MA program has seen expansive growth in its share of overall Medicare enrollment. In 2021, more than 26 million people or 42% of the total Medicare population were enrolled in a Medicare Advantage plan. This growth in MA is projected to continue in the coming years. As MA enrollment has expanded, so has the number of Medicare beneficiaries switching from traditional Medicare to MA plans. Using data from 2015 to 2020, we found that while some Medicare beneficiaries elect to switch to FFS, the rates have decreased in the past few years reaching a low of 1.6% in 2020. On the other hand, there has been an uptick in beneficiary switching to MA over the same time period.

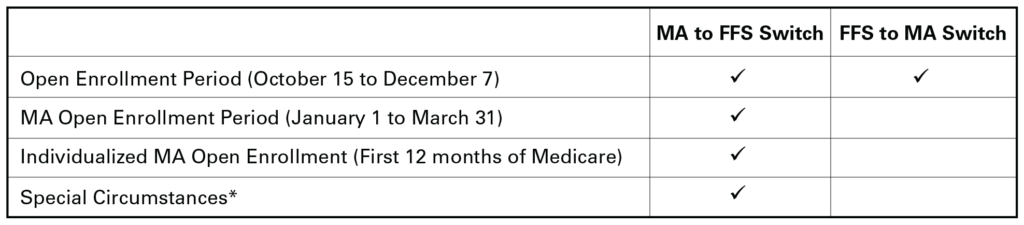

Enrollees can switch from MA to traditional Medicare or from traditional Medicare to MA for a variety of reasons, including changes in health status, inclusion of nonmedical services in MA plans, and access to specialized healthcare providers. In terms of the timing, there are certain conditions under which a switch can occur between the two alternative programs (Exhibit 1). MA enrollees have greater flexibility in shifting to traditional Medicare while current FFS enrollees are more constrained. In addition to the avenues described below, Medicare-Medicaid enrollees (or dual eligibles) have additional options for moving in and out of MA.

Exhibit 1: When Can Medicare Enrollees Switch Between FFS and MA?

*Special circumstances include moving away from an MA plan’s service area, admission to an institutional care setting, a change in Medicaid eligibility, enrollment in a (non-Medicare) private plan, or enrollment in drug coverage that is equivalent to Medicare Part D.

Given the dynamics of Medicare enrollment trends and the growing popularity of MA, it is illuminating to examine the relative occurrence of switching from MA to FFS and vice versa. Before our analysis, we hypothesized that the growing popularity of MA led to an increased rate of switching from FFS to MA over time and a decline in the switching rate from MA to FFS.

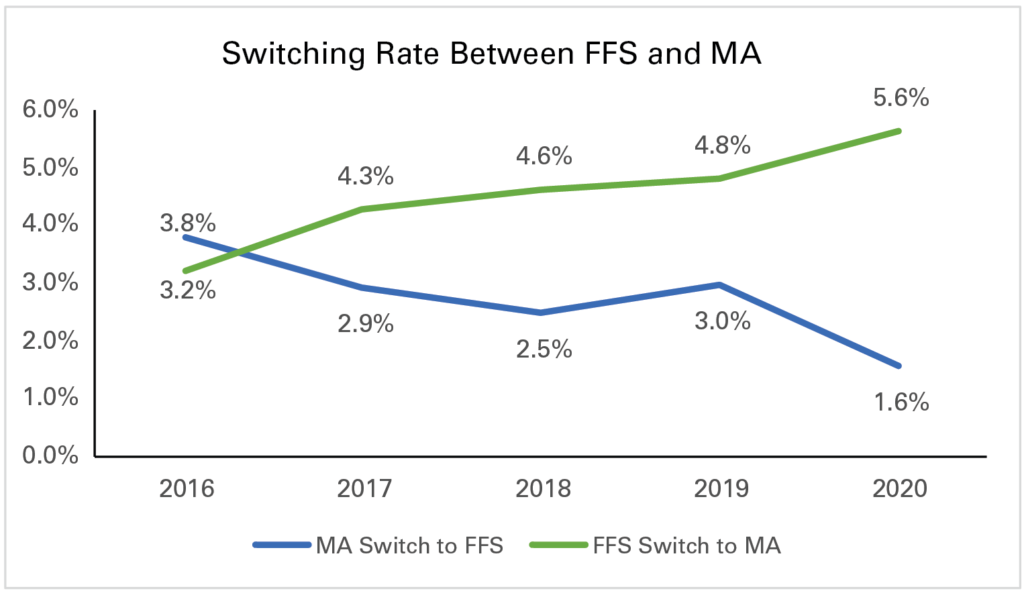

Our analysis used beneficiary enrollment data from the Master Beneficiary Summary Files and was limited to beneficiaries with at least 12 months of prior Medicare enrollment. This ensures that our findings are not driven by new Medicare enrollees making initial switching choices. We found an increasing switching rate from FFS to MA and a declining rate from MA to FFS from 2016 to 2020 (Exhibit 2). The difference in switching rates has increased over time. A separate analysis of trends among new Medicare enrollees and dual eligibles showed even larger disparity in switching rates for these groups (e.g., in 2020 12.5% of newly enrolled in FFS switched to MA in the next year vs 2.7% of MA enrollees who switched to FFS). A breakdown and comparison of switching rates by gender indicates the movement to MA is driven by greater switching amongst women.

Exhibit 2: Percent of Enrollees Who Switched From One Program to Another

Note: KNG Health analysis using 2015-2020 Master Beneficiary Summary Files.

Overall, these findings provide insight on how enrollment in Medicare is changing and what groups are driving this change. It also implies that future growth in MA will be, at least, partially driven by current Medicare enrollees shifting from FFS to MA. Growth in switching from FFS to MA may raise issues on continuity of care, if MA plans have narrow provider networks. In our future analysis, we will further explore how enrollment trends have changed across gender and racial categories, as well as how health status affects switching decisions.

Services : Blog, Payment Policy & Delivery System Innovation Expertise: Medicare, Medicare Advantage